Dubai Real Estate Market Forecast 2025

The Dubai real estate market continues to evolve as we move through 2025, presenting both challenges and opportunities for investors. After the unprecedented growth seen in recent years, the market is showing signs of maturation and stabilization, with more sustainable growth patterns emerging. This comprehensive analysis explores the current state of Dubai's property market, examines emerging trends, and identifies the most promising investment opportunities for the remainder of 2025 and beyond.

Market Overview: Stabilization After Rapid Growth

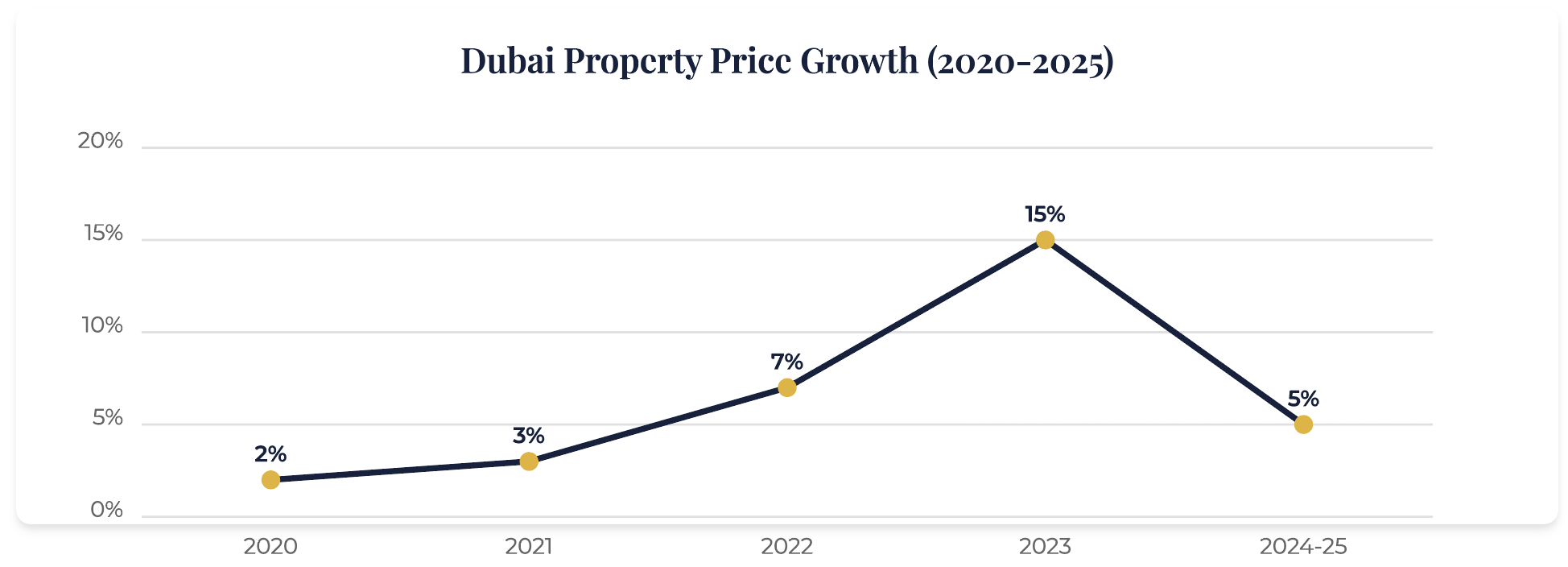

Following the record-breaking performance of 2023-2024, Dubai's real estate market has entered a phase of moderate growth in 2025. According to the latest data from the Dubai Land Department, property prices have increased by approximately 5% in the first quarter of 2025, a significant moderation from the 20% growth rates seen in previous years.

This stabilization is widely considered a positive development by market analysts, as it indicates a maturing market less prone to the boom-and-bust cycles that characterized earlier periods. The more sustainable growth trajectory is supported by:

- Stronger regulatory frameworks implemented by the Dubai Land Department

- More discerning investors focused on long-term value rather than speculative gains

- A more diverse property ecosystem catering to various segments of the market

- Increased end-user demand as more residents choose to purchase rather than rent

The data clearly shows a market that experienced rapid acceleration during 2022-2023, followed by a normalization in 2024-2025. This pattern aligns with Dubai's economic development strategy, which emphasizes sustainable long-term growth over rapid but potentially unstable gains.

"Dubai's real estate market in 2025 represents the maturation of the sector, with more sustainable growth patterns indicating a healthy market that can provide long-term value to investors."

Emerging Hotspots: Where to Invest in 2025

While established luxury areas continue to perform well, 2025 has seen the emergence of several up-and-coming neighborhoods that offer attractive investment potential. These areas combine relatively lower entry points with promising growth prospects due to ongoing and planned infrastructure developments.

1. Dubai South

With the continued expansion of Al Maktoum International Airport and the legacy of Expo 2020, Dubai South has transformed into a major residential and commercial hub. The area offers investors:

- Affordable entry prices compared to established communities

- Strong rental yields averaging 7-8%

- Proximity to major infrastructure projects

- Significant appreciation potential as development continues

2. Jumeirah Village Circle ( JVC)

Once considered a peripheral area, JVC has matured into a thriving community with excellent amenities and connectivity. Key advantages include:

- Well-developed community infrastructure

- Diverse property options at competitive price points

- Rental yields of 6.5-7.5%

- Strong end-user demand driving sustainable growth

Dubai's skyline continues to evolve with new developments shaping the city's real estate landscape

3. Tilal Al Ghaf

This emerging master-planned community by Majid Al Futtaim is gaining significant attention in 2025. The area offers:

- Premium lifestyle amenities centered around a lagoon

- Quality construction from a reputable developer

- Strong price growth trajectory

- Attractive payment plans for off-plan properties

4. The Valley

Located on the Dubai-Al Ain Road, The Valley has emerged as a viable alternative for families seeking affordable yet quality housing. Highlights include:

- Competitive price points for townhouses and villas

- Family-oriented amenities and green spaces

- Improved connectivity to central Dubai

- Potential for significant medium-term appreciation

The most promising investment opportunities in 2025 are found in emerging communities that combine affordable entry points with strong infrastructure development and growing end-user demand."

Investment Strategies for 2025

The evolving market dynamics call for refined investment strategies that align with current trends. Here are the most effective approaches for investors looking to enter or expand their presence in Dubai's real estate market in 2025:

1. Focus on Mid-Market Residential Properties

Properties priced between AED 1-3 million are experiencing robust demand from both end-users and investors. This segment offers:

- Broader pool of potential buyers and tenants

- Lower vacancy risk compared to luxury properties

- Attractive payment plans from developers

- Higher rental yields compared to premium segments

2. Consider Select Off-Plan Opportunities

Despite some concerns about oversupply, carefully selected off-plan investments from reputable developers still present compelling opportunities:

- Favorable payment plans spread over construction period

- Lower entry price compared to ready properties

- Potential for capital appreciation upon completion

- Option to sell before completion (subject to developer terms)

Waterfront properties continue to command premium prices and attract international investors

3. Diversify Across Property Types

Savvy investors are increasingly diversifying their Dubai real estate portfolios across different property types:

- Residential apartments for steady rental income

- Townhouses and villas for capital appreciation

- Commercial properties for higher yields (though with higher entry costs)

- Holiday homes for premium short-term rental returns

4. Leverage the Golden Visa Program

Dubai's Golden Visa program continues to be a significant driver of premium property investment in 2025. Investors should:

- Explore properties that qualify for the AED 2 million investment threshold

- Consider combining multiple properties to reach the required investment level

- Understand the long-term benefits of residency for business and lifestyle

- Factor in the added value of the visa when calculating overall investment returns

Key Market Influencers in 2025

Several factors are shaping the trajectory of Dubai's real estate market in 2025, creating both opportunities and challenges for investors:

1. Global Economic Conditions

The broader global economic landscape continues to influence Dubai's property market:

- Global interest rate trends affecting mortgage affordability

- International investment flows seeking stable havens

- Currency fluctuations impacting buyer purchasing power

- Geopolitical factors driving wealth relocation to Dubai

2. Government Policies and Initiatives

Dubai's government continues to implement policies that support the real estate sector:

- Expanded residency options through various visa programs

- Strategic infrastructure investments enhancing property values

- Regulatory improvements increasing market transparency

- Tax-free environment maintaining Dubai's competitive advantage

3. Supply and Demand Dynamics

The balance between new supply and market demand is crucial for market stability:

- Approximately 182,000 new units expected to enter the market by 2025-2026

- Population growth and visa initiatives expanding the buyer pool

- Shift towards end-user market reducing speculative pressure

- Segment-specific supply-demand imbalances creating varied opportunities

"Dubai remains competitively priced compared to other global luxury markets, offering investors significant value proposition and growth potential even as we see market stabilization in 2025."

Outlook and Recommendations

Looking ahead to the remainder of 2025 and into 2026, we anticipate:

- Continued price stabilization with moderate 4-6% annual growth

- Increased focus on quality from both developers and buyers

- Growing emphasis on sustainability features in new developments

- Further market segmentation creating varied investment opportunities

For investors looking to capitalize on Dubai's real estate opportunities in 2025, we recommend:

- Conduct thorough due diligence on developers, especially for off-plan purchases

- Focus on areas with infrastructure developments and improving connectivity

- Consider medium-term investment horizons (5-7 years) for optimal returns

- Work with reputable real estate advisors who understand market nuances

- Stay informed about regulatory changes that may impact the market

The Dubai real estate market in 2025 offers a balanced landscape of opportunity and stability. With strategic property selection, careful timing, and appropriate investment strategies, investors can position themselves to benefit from both rental income and capital appreciation in one of the world's most dynamic property markets.